With the adjusted monthly numbers starting to settle and the larger trends from the entire year beginning to emerge, it’s a little hard not to ask. Is this good news or not?

Typically, reviewing employment data isn’t overly challenging. It’s making observations of macro and micro changes in the U.S. labor market, and taking note of where and how individual industries are behaving. The difficulty usually happens when trying to predict what might happen next. But even this part has some leading indicators that provide some degree of insight.

Most of us appreciate positive job growth but with inflation rates still hovering uncomfortably high, are these numbers still too good? Some metrics have returned to levels we grew accustomed to pre-pandemic, allowing us to take a relaxing breath of familiar air. Yet, the past two years have also taught us how quickly situations can change, reinforcing the value of preparation and the folly of being too comfortable with the ways things are.

Perhaps, this is the emerging story of the U.S. labor market as we review and recap the happenings of 2022. There are indeed opportunities for growth, improvement, and awareness amid a sea of constant adjustment, shift, and transition. Keep reading as we look back at not only the performance of the labor market in Q4 but the larger perspective of last year as well.

If you prefer to have this quarterly labor report delivered directly to your inbox, subscribe to our newsletter today.

U.S. Labor Market Activity

United States Job Growth

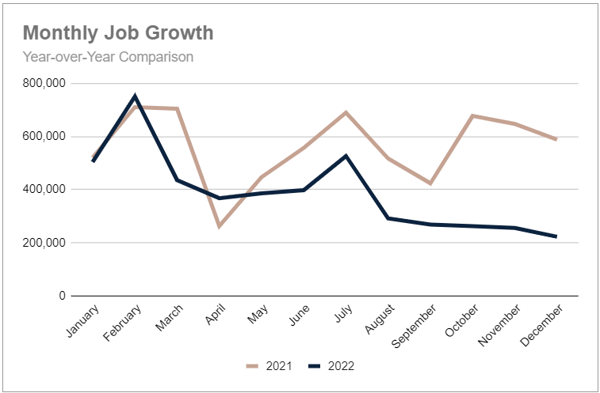

Consistent with the rest of 2022, the labor market continued to post positive job growth each month of the last quarter. However, the 263,000 new jobs added in October were 2% behind September and the highest level for the quarter. November posted another 2.7% decrease for the month with 256,000 more jobs. December ended the year by adding 223,000 new jobs, and a dramatic 12.9% drop from the previous month.

Attempts by the Federal Reserve to slow the U.S. economy, specifically inflation, are having an impact. At least on job growth. Between March and December, interest rates increased seven times. This past summer, Federal Reserve Chair Jerome Powell said, “Without price stability, the economy does not work for anyone. In particular, without price stability, we will not achieve a sustained period of strong labor market conditions that benefit all.”

The ongoing challenge is to pull the cost of goods back in line without risking job loss by way of increased unemployment rates. (More to come on this in a moment.)

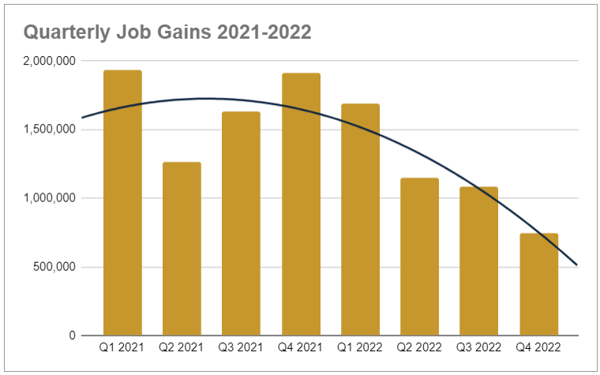

The U.S. labor market added 742,000 new jobs in Q4. This was a 32% decrease from the third quarter and 61% behind the last quarter of 2021. In total for the year, just under 4.7 million new jobs were created, 31% below the over 6.7 million jobs added in 2021.

The slower pace of job growth last quarter also dropped the monthly average for the year to a little over 389,000 jobs per month. This is a difference of more than 172,000 jobs every month compared to the average gains of nearly 562,000 posted in 2021.

United States Unemployment Rate

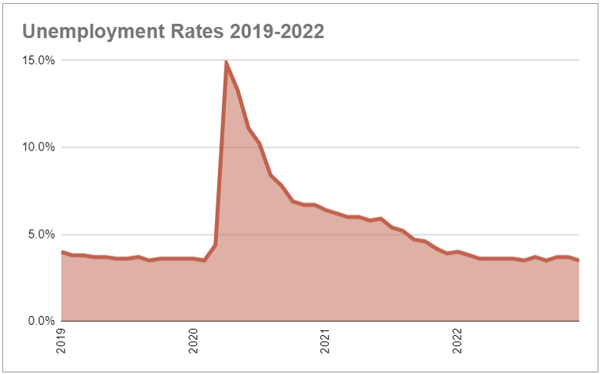

The unemployment rate held at 3.7% in October and November before dipping down to 3.5% in December. For the year, the average unemployment rate was 3.6%, on par with the average rate back in 2019. This was 31.5% below the average for 2021, and 54% less than the pandemic high of 8.1% in 2020. Throughout 2022, unemployment fluttered between 3.5% and 3.7% with only January and February holding higher rates at 4% and 3.8%, respectively.

Interestingly, the similarity in unemployment rates entering and exiting the pandemic was nearly identical throughout both years. In each period, the rate in January was 4% followed by a decline to 3.8%. Although, the rate did decrease again to 3.6% in March of this past year where it held at 3.8% in March of 2019. Both years also experienced a modest increase to 3.8% in August.

The last time the unemployment rate nestled comfortably in the 3.5 - 3.8% range was from 1966 to 1969. Although it came very close in 2000 when the rate danced around the 4% level for much of the year.

.png?width=600&height=393&name=Unemployment%20Rates%20Pre%20%26%20Post-pandemic%20(2019%20vs%202022).png)

Among the industries we closely follow, Leisure and Hospitality still hold the highest unemployment level at 5.4% at the end of December. This is a little more than a point below the 6.7% rate at the end of 2021.

Manufacturing held the lowest unemployment rate at the end of 2022 at 1.8%, a full point below December 2021.

Construction ended the year at 4.4%, Retail at 3.6%, Information was 2.4%, Professional and Business Services ended at 3.5%, and Education was 2%. All down from their December 2021 levels.

Financial Activities ended slightly higher compared to the prior year, increasing from 2.4% to 2.6%. Transportation also had a year-over-year ending increase of 3.3% to 4%.

Industry Employment Trends

Year-over-Year Industry Employment Trends

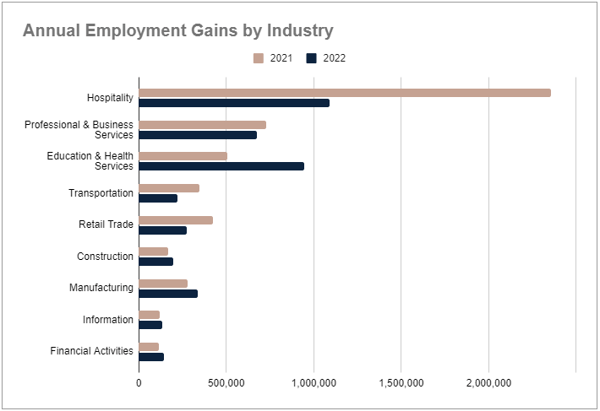

Five of the nine industries we follow generated more jobs in 2022 than they had in 2021. The largest increase was in Education & Health Services which saw an 88% year-over-year increase with 443,000 more jobs added.

Financial Activities had a 25% gain (29,000 jobs), Construction was up 16.5% (28,000 jobs), Manufacturing improved by almost 10% (57,000 additional jobs), and Information had a 5% increase (15,000 more jobs).

The Hospitality industry continues to struggle with close to 1.3 million fewer jobs added in 2022, reflecting a 54% year-over-year decrease. Two other industries with notably fewer jobs added this past year were Transporation, which added 124,000 fewer jobs, and Retail, with 152,000 fewer. Each, a decrease of 36%. Professional & Business Services also declined by almost 8% (56,000 fewer jobs).

Fourth Quarter Industry Employment Trends

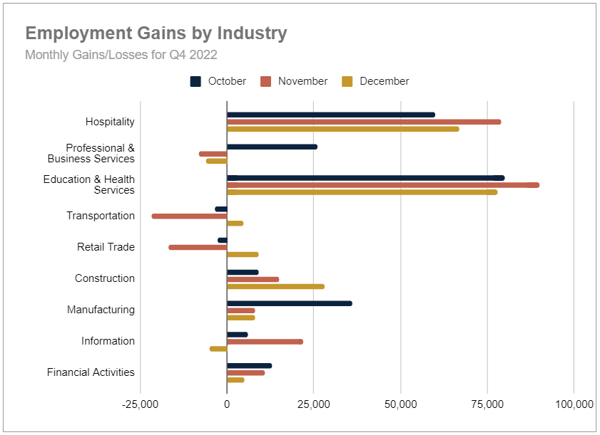

Diving into the monthly job gains over the fourth quarter, the results were rather mixed. Again, over half of the industries we track saw job gains in each month of the quarter but only Construction continued to gain momentum with their biggest gains coming in December.

October was the strongest month of the quarter for Professional & Business Services, Manufacturing, and Financial Activities. While Hospitality, Education & Health Services, and Information had their strongest gains in November.

Professional & Business Services, Transportation, and Retail experienced job losses in two of the three months, while Information only declined in the last month of the year.

Job Growth in the Business & Professional Services Industry

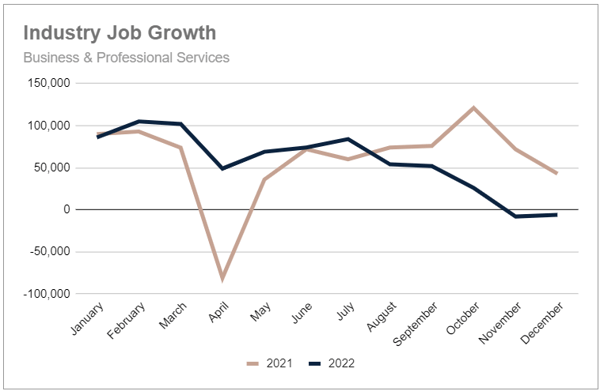

Business & Professional Services had a strong start to the year with triple-digit job gains in February and March. However, those gains quickly slowed as the year progressed, ending with job losses in November and December.

The fourth quarter for this industry ended with a net gain of only 12,000 jobs, 94% below Q3 and 95% behind Q4 2021 totals. For the year, Business & Professional Services added 674,000 new jobs compared to 730,000 in 2021.

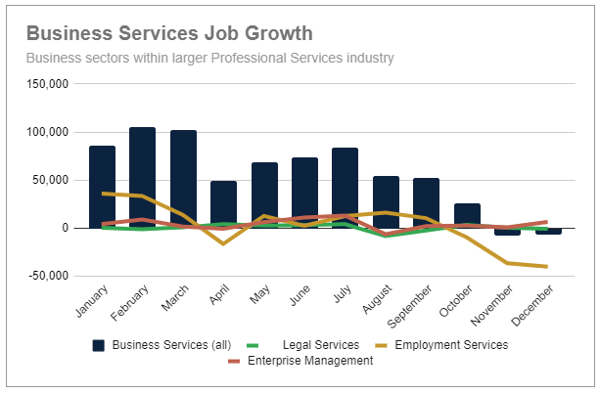

Diving a bit deeper into this industry, Legal Services recouped nearly two-thirds of its job losses in Q3 with a gain for the fourth quarter of 3,900 jobs despite posting a modest loss in December. The strongest quarter for this industry came in Q2, followed by its weakest quarter for the year. In total, Legal Services only gained 9,300 jobs for the year.

Employment services ended the year with a net gain of 38,000 jobs but it has been tough to hold on to these new jobs. Gains made in the first quarter initially held with only a modest dip in Q2. This was followed by stronger gains in Q3. However, the loss of over 85,000 jobs in the last quarter negated first-quarter gains. This was one of the sectors that negatively impacted the Professional & Business Services industry the most. (The other was Administrative Services.)

The Enterprise Management sector saw a fair amount of fluctuations over the year as well. However, it only had two months of relatively minor job losses in April and August, ending the year with a total gain of more than 53,000 new jobs. Looking at the quarterly numbers, there were gains in each period that were much more consistent than in the other sectors. Almost 11,000 jobs were added in Q4.

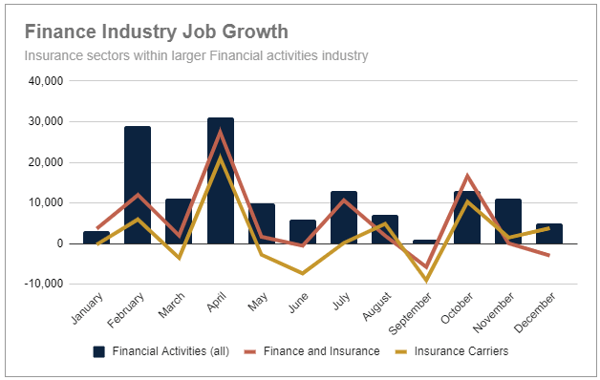

Job Growth in the Finance & Insurance Sector

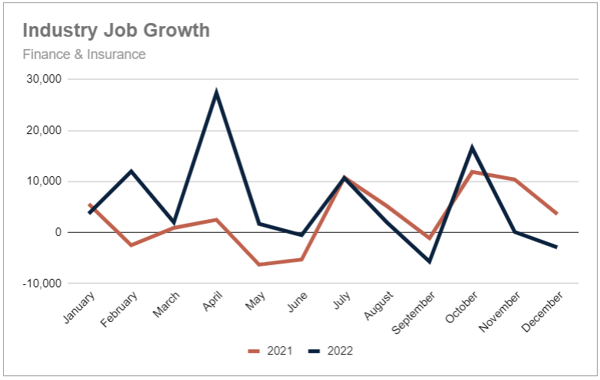

The Finance & Insurance sector (a subset of the Financial Activities industry) again ended the quarter with job losses like it experienced at the end of the second and third quarters. However, it was able to close Q4 with a respectable addition of 13,800 new jobs despite the loss of nearly 3,000 in December.

The fourth quarter ended with a 97% gain over Q3. Yet only 53% of the gains made in the last quarter of 2021 when this sector had added nearly 26,000 new jobs. For the year, more than 67,000 jobs were added in Finance & Insurance, an 88% increase over 2021 totals. And somewhat surprising given the volatile monthly activity.

The Finance & Insurance sector sits within the broader Financial Activities industry.

As a whole, the Financial Activities industry gained 29,000 new jobs in Q4. Although gains in the first half of the year were nearly double that of the second half. Fourth quarter totals account for about 21% of the yearly total of 140,000 new jobs. However, the industry was able to maintain positive gains each month despite some monthly losses in some of the sectors within this group.

Beyond the Finance and Insurance sector, the other area we regularly review is Insurance Carriers which had its strongest quarter in Q4 with the addition of 15,600 new jobs. Most of these gains came in October with more than 10,000 new jobs before posting modest gains in November and December. For the year, 25,000 jobs were added in this sector which was also constantly bouncing between monthly gains and losses.

U.S. Hiring Trends

At the end of November, the Bureau of Labor Statistics reported that total job openings remained at 10.5 million, barely 1% lower than its peak in March 2022. With November also posting 6 million unemployed workers, that equals 1.75 jobs for each worker. This figure is slightly higher than where it was in August (1.7 jobs per unemployed person) but still below the peak of 2 jobs reached in May.

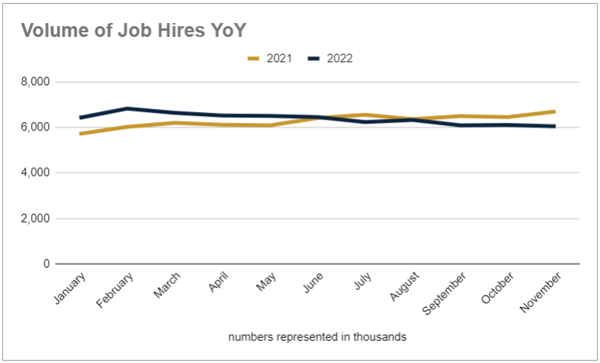

The volume of job hires continues to slowly decrease with 6.1 million hires made in November across the U.S. from the peak in February at just over 6.8 million hires. Perhaps the least fluctuating metric is still the participation rate which remains at just above 62%, only moving slightly from month to month.

.png?width=600&height=355&name=Job%20Hires%20in%20Past%2014%20Months%20(Oct%202021%20-%20Nov%202022).png)

Since July, the volume of monthly job hires has remained below 2021 levels. However, the total number of hires from January thru November 2022 is still outpacing 2021 by nearly 6.8 million hires (10.7%).

Hiring within the Business & Professional Services Industry is also still receding down to 1.1 million hires in November. This is now a 17% decrease from the highest levels seen back in April at over 1.3 million hires, with the monthly average slightly above 1.2 million.

The Finance and Insurance industry is only seeing moderate signs of a slowing pace of hiring. Here too, the highest levels still happened in April at 188,000 and the lowest point now in October at 136,000 hires. However, hires increased again in November to 147,000. The monthly average for January through November is 154,000.

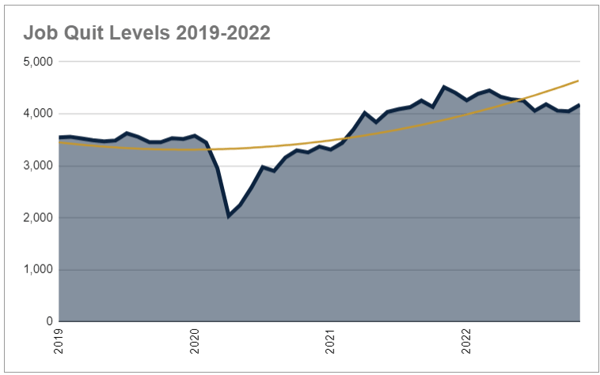

Job Quit Trends

The level of job quits inched upward again in November to just below 4.2 million employees (2.7% of the U.S. workforce). For the 2022 calendar year through November, the monthly average still sits at 4.2 million.

Unfortunately, this means 2022 will be another record year of job quits. Through the first 11 months of the year, the volume of quits has topped 46 million, surpassing 2021 levels for the same period by 2.8 million quits (up 6%). Compared to 2020 levels, that is 13.8 million more (43% increase).

A Final Perspective

Media coverage on the labor market will quickly focus on any layoffs plaguing specific industries. And while job growth has certainly slowed, it hasn’t stalled. Maybe we’ve gotten so accustomed to the massive gains each month that moderate growth now seems problematic when it may be more of what we should have – manageable growth.

The other positive metric to note is the historically low unemployment rate. And considering the changing economic tide, it won’t stay at this level indefinitely. But to have it endure countless rounds of interest rate increases should signal the current strength of our labor market.

One substantial shift we have been noticing is the change from external to internal pressures on businesses. Not long ago, the primary challenges included supply chains, availability of talent, and technology needs to support remote work. Now, businesses are finding their attention is drawn to company culture, employee engagement, and retention.

We expect the labor market to experience more changes in the coming months. More layoffs in certain industries will continue due to overhiring and changing markets. Yet, this doesn’t have to be your organization’s story.

If you are in a hiring mode, develop a solid hiring strategy that includes the right resources to help you reach your goals. Pay attention to how you can develop and support the employees you have now so they can be the team you need tomorrow.

What questions and concerns do you have about building and supporting your team? We’re here to help.

.jpg)

.png)

.png)