The United States labor market continues to be a challenge to forecast. While most industries continue to report job gains, sectors of each category have seen wide fluctuations. Even more frustrating is how individual businesses continue to struggle to not just hire talent, but retain these individuals as well.

Monthly job gains cast a cloud over the rebounding efforts of the U.S. economy. High numbers of job quits, supply chain issues, and growing inflation have not helped either. However, the continuing decline of the unemployment rate with fewer claims and layoffs may be the optimistic sign we’ve been waiting for.

In addition to reporting on overall and select market job growth, industry trends, and unemployment rates for the third-quarter of this year, we also took a closer look at the trends and causes of the growing threat of employees quitting and leaving their current roles in record numbers.

U.S. Labor Market Activity

United States Job Growth

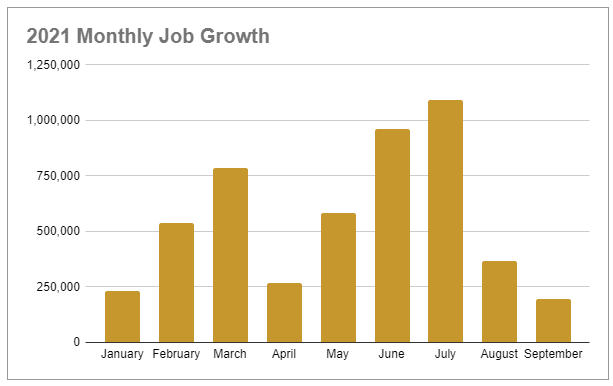

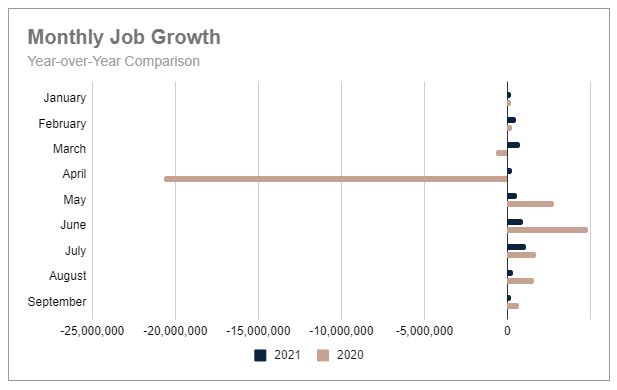

Third-quarter job growth started incredibly strong, continuing the upward momentum of the second quarter. Unfortunately, what followed seemed to reflect Sir Isaac Newton’s law of gravity (what goes up, must come down) a bit too well.

Over one million new jobs (1,091,000) were added to the U.S. labor market in July. In August only 366,000 jobs were added, with just 194,000 more in September. The results sound a bit better when the quarter is viewed as a whole with almost 1.6 million new jobs added. Looking at 2021 overall, this was a 9% decrease from Q2, but a gain of 6% over Q1 numbers.

Year-to-date, over 4.8 million new jobs have been added to the U.S. labor market, representing a 152% increase over the still shocking losses seen during the same period last year, which reflected a loss of nearly 9.2 million jobs.

So what caused the sharp declines? The largest factor was a resurgence of COVID cases thanks to the Delta variant during the late summer months which impacted travel and hospitality industries especially hard. An end to pandemic-relief stimulus, raw material shortages, and supply chain bottlenecks also negatively impacted consumer spending and the need for additional labor in many industry sectors.

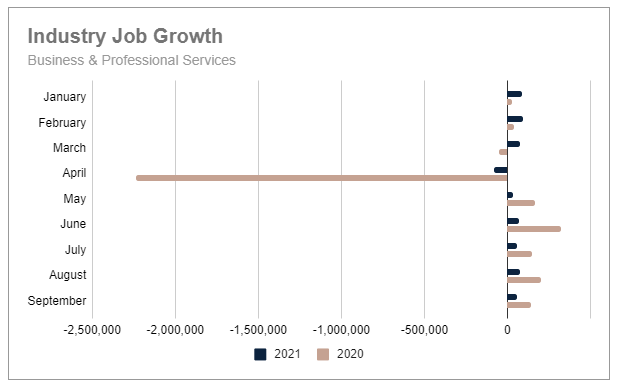

Job Growth in the Business & Professional Services Industry

Business and Professional Services not only recovered this quarter but was much less volatile than the previous quarter with total job growth of 194,000 jobs, the majority of which (74,000) came in August. This was a 618% increase over Q2 numbers yet still 60% below the third quarter gains of last year.

The largest gains in the sector were in Architectural and Engineering Services and Management Consulting Services. The most significant job losses were in Employment services, specifically Temporary Help.

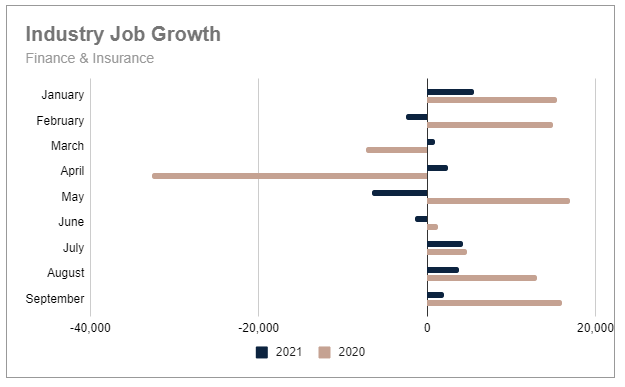

Job Growth in the Finance & Insurance Industry

In the Finance and Insurance industry, second-quarter losses were not only regained but added to as well, ending the third quarter with over 10,000 new jobs, although losing momentum with each month. Overall, Q3 ended 287% over Q2, however still 70% below Q3 2020 levels.

The highest segment of job gains in this sector was in Real Estate, while the largest job losses were seen by Insurance Carriers and Commercial Banking.

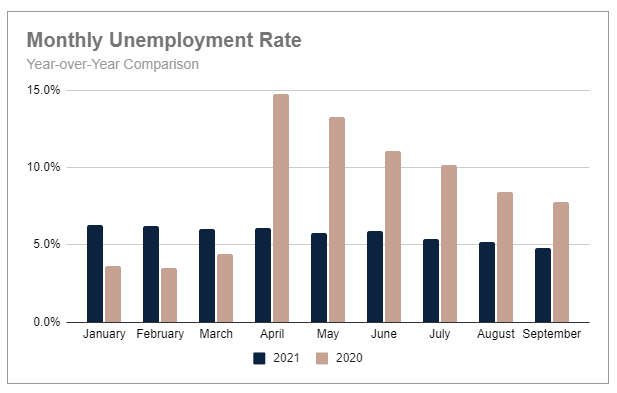

United States Unemployment Rate: Q3, 2021

The unemployment rate dropped four-tenths of a percent in September to 4.8%, marking the lowest rate this year. This was also the second-largest monthly decline. (July had the largest monthly decline of one-half percent to 5.4%.)

This metric continues to hold the most optimistic news, dropping one and a half points since January, and a full three percentage points lower than September of last year. The last time the unemployment rate was in the four percent range was back in March of 2020, at the start of the pandemic shut-down, when the rate was at 4.4%. Only January and February of last year saw unemployment rates below 4% with rates of 3.6% and 3.5%, respectively.

At the end of September, the Leisure and Hospitality and Construction industries continue to hold the highest unemployment rates in the U.S. at 7.7% and 7.3%, respectively. On the other end of the spectrum, the lowest rates are held by Government at 2.4% and Financial Activities at 2.5%.

Job Quit Trends

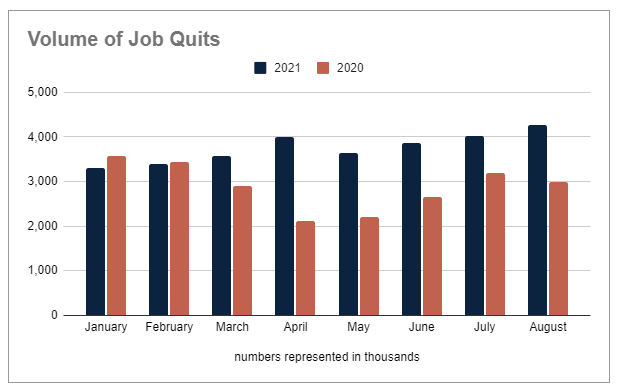

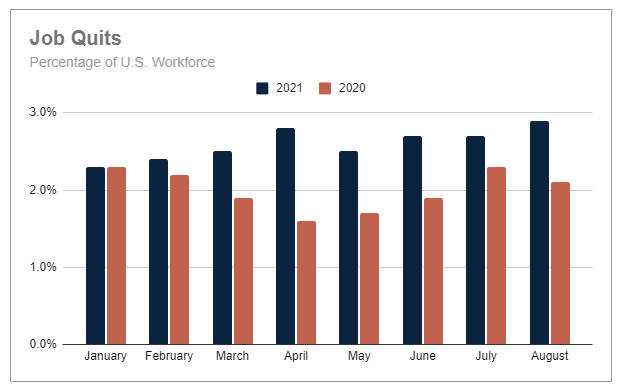

Regardless of what you are calling the wave of employees quitting their jobs, the biggest question for most employers isn’t what to call it. Instead many are asking the vital questions of when they will feel the biggest impact, when the wave may be over, and most importantly, how they can combat the problem. Unfortunately, the numbers continue to be on the rise each month.

In August (the latest month of available data from the Bureau of Labor Statistics), nearly 4.3 million employees called it quits, representing 2.9% of the U.S. workforce. While this was only a modest two-tenths of a percent increase over July, year-over-year numbers reflect the larger impact.

Looking back over ten years of data, August charted the highest level and percentage to date. Year-to-date levels are 30.5% higher than last year, and about 6% higher than 2019 levels.

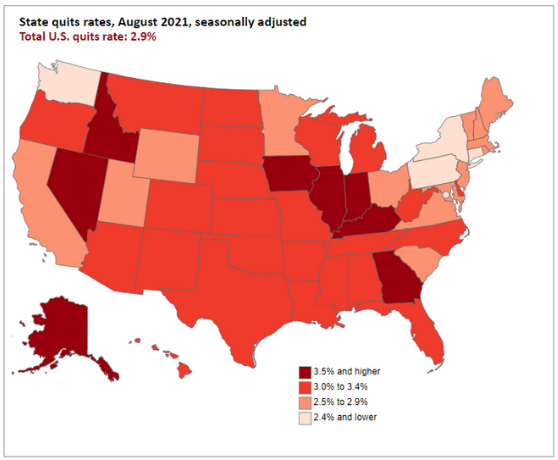

Employees in the most densely populated states have the lowest numbers of reported job quits. However, with most states posting quit rates of 3 - 3.4% and eight states at 3.5% and above, this trend doesn’t look likely to end any time soon.

There are multiple causes and influences at play currently according to Bloomberg.com. Employees who decide to leave are attracted by a wide range of appealing opportunities which include greater flexibility, appealing work and cultures, and in many cases increased wages.

Those who initially decide not to leave are feeling the impacts of reduced staff, supply issues, and other COVID-related challenges such as vaccine mandates or managing the care of sick family members quarantining at home. The added stress is causing elevated levels of employee burnout and frustration. On a secondary level, some employees nearing the age of retirement are simply deciding they have had enough and are opting for early retirement.

It is no longer enough for businesses to focus on how to hire the right talent, employee engagement needs to be a top priority as well.

U.S. Hiring Trends

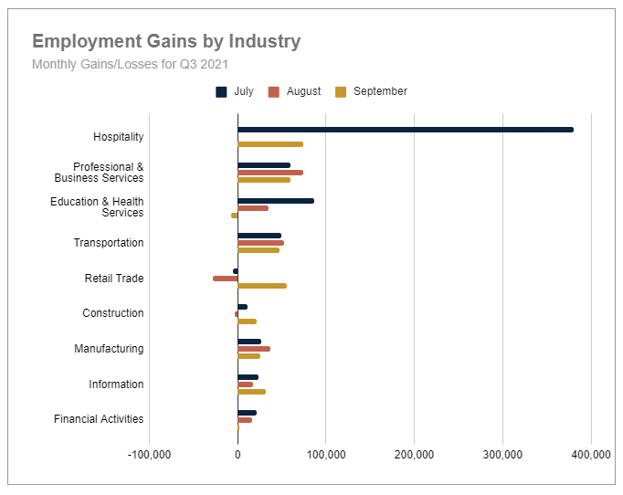

Q3 Industry Employment Trends

This quarter, over half of the nine leading industries we track saw job gains in all three months: Professional and Business Services, Transportation, Manufacturing, Information, and Financial Activities. Retail Trade rallied in September after job losses in the previous two months.

Hospitality seemed to treat August as a month-long holiday with zero job gains during the month. New jobs were added in September but at only 19% of July numbers. Retail trade also struggled with job losses in July and August before rebounding with a net gain for the quarter in September.

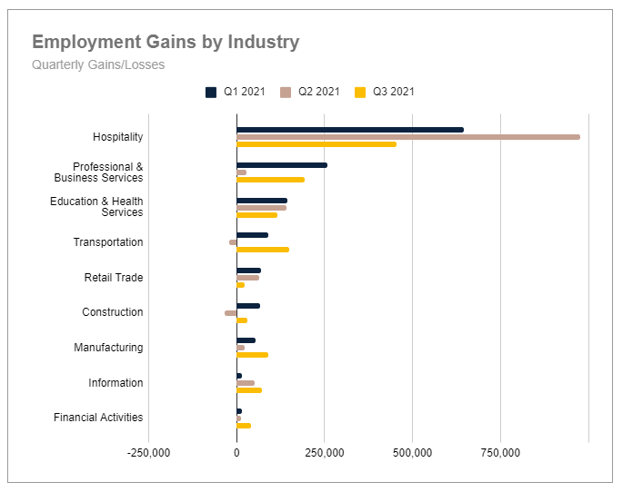

Year-to-Date Industry Employment Trends

Year-to-date, only two industry sectors (Transportation and Construction) have had quarterly negative job gains which is a welcome sign compared to the losses of last year that many industries are still trying to overcome. (Both of which were in Q2.) Even better positive indicators are that Transportation, Manufacturing, Information, and Financial Activities all had their highest gains this past quarter.

The weakest third-quarter numbers were posted by the Hospitality, Education and Health Services, and Retail Trade sectors. Education and Health Services remains to be the least volatile this year so far.

Get our quarterly labor reports delivered directly to your inbox. Subscribe to our newsletter today.

.jpg)

.png)

.png)