Are we back to normal yet? Do we remember what that even looks or feels like? Maybe we have just scrapped the old definition and are setting new benchmarks and standards now. And it almost feels like that. Some areas are showing a slow, almost cautious start to the year while others look to be making up for lost ground.

Quarterly job creation is up but so is the volume of job quits (yet again). And while unemployment levels are relaxing, our questions seem to be more direct. Have businesses now filled the gaps created by the pandemic? Is the current U.S. economy causing organizations to hire more cautiously? Are companies really growing or are they just staying consistent as they seemingly trade talent around their industries?

Let’s take a closer look at what has happened this past quarter and where organizations can prepare going forward.

U.S. Labor Market Activity

United States Job Growth

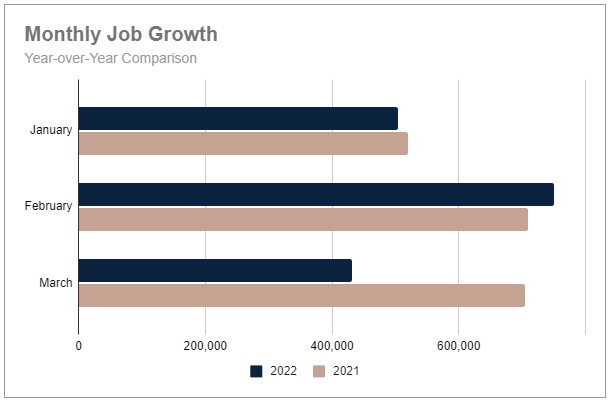

In the first quarter, almost 1.7 million new jobs were added to the United States labor market. January started with the addition of a robust 504,000 jobs landing just 3% behind the numbers posted for January 2021. However, it also continued the downward trend that started in November of last year with a 14% decline compared to December.

February brought a healthy rebound as it had in 2021 with the highest monthly job gains of the quarter. This year, 750,000 new jobs were added in the second month. This was a 49% month-over-month increase and a 5.6% year-over-year increase. However, the similar year-over-year pattern of job gains abruptly ended when March posted only 431,000 new jobs. This was a 42.5% drop for the month and a 39% decline compared to March of 2021.

As a whole, job gains in Q1 of 2022 were down almost 13% compared to Q1 2021, and about 12% less than gains in the previous Q4 2021. The monthly average for the first quarter is also 83,000 fewer new jobs than last year.

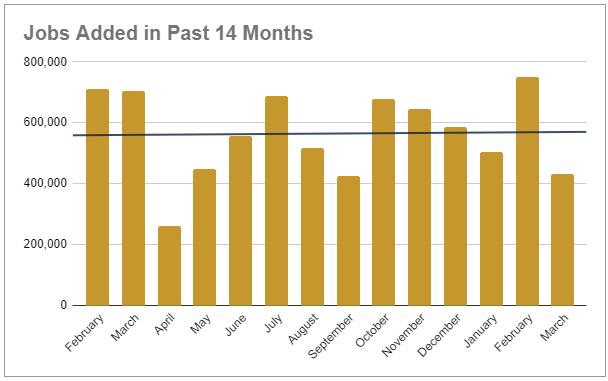

It will be interesting to see how job gains fair the rest of this year, as monthly gains have been anything but steady over the past 14 months. The monthly volatility also means the long-term trend is only barely above a flat line.

Job Growth in the Business & Professional Services Industry

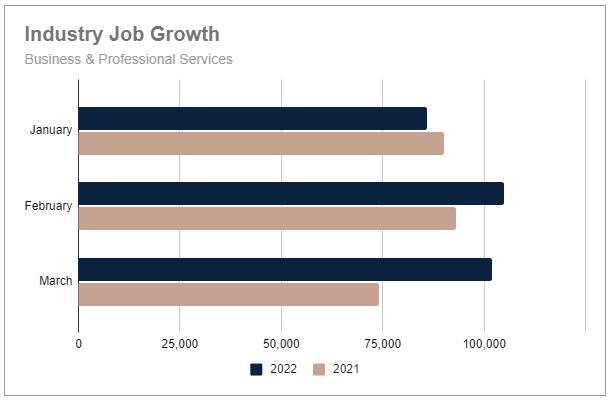

Business and Professional Services started the quarter with a strong rebound from where this industry ended in 2021. January posted 86,000 new jobs, a 100% increase over December and just 4% behind last year.

February continued the climb with a 22% gain for the month at 105,000 more jobs. This was a 13% year-over-year gain.

March was nearly even at 102,000 and a modest 3% dip for the month. However, this was nearly 38% over last year.

For the quarter, Q1 of this year saw a 24% increase over the previous quarter and a 14% year-over-year gain for organizations in the Business and Professional Services industry.

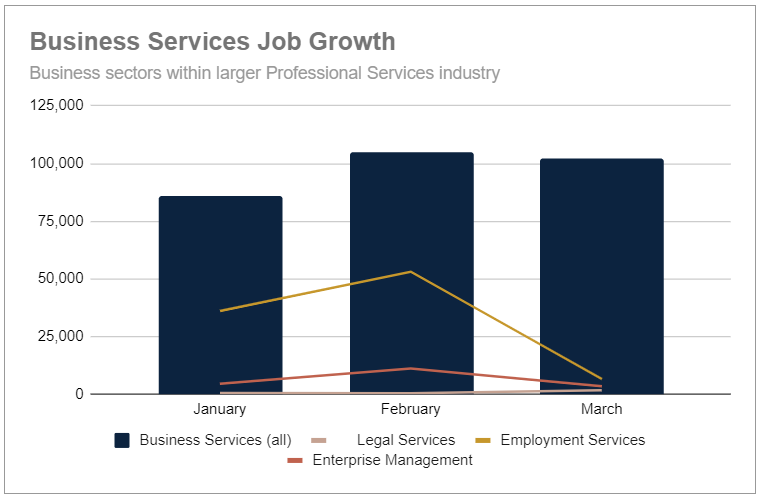

Diving a bit deeper into the Business and Professional Services industry, we wanted to provide a closer look at the Legal Services, Employment Services, and Enterprise Management sectors.

It’s a bit hard to decipher in the graph below, but Legal Services started the quarter off slowly with minimal gains in new jobs in January and February at only 500 and 400, respectively. However, the sector nearly doubled those numbers in March with 1,700 new jobs added.

Employment services began the year with just over 36,000 new jobs before adding 53,000 more in February. The momentum stalled a bit in March though with only a modest 6,600 new jobs added.

The Enterprise Management sector was the most turbulent out of the group with 4,500 new jobs added in January before jumping to over 11,000 in February. This sector too lost forward traction in March with only 3,500 more jobs added.

We’ll continue to watch these individual sectors throughout the year and report on their performance.

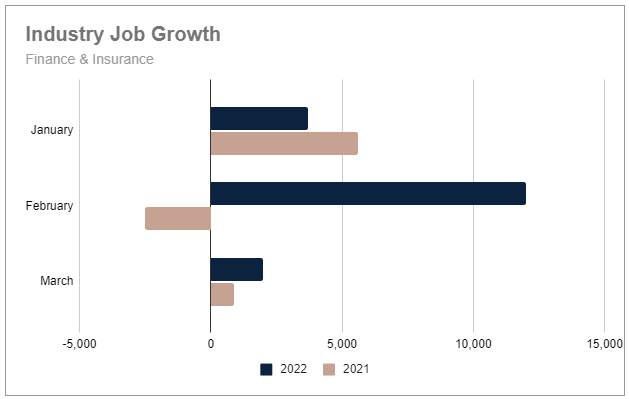

Job Growth in the Finance & Insurance Sector

Like the Business and Professional Services industry, Finance and Insurance had their largest gains in February. Although the month-to-month results within the quarter had much wider swings. January posted only 3,700 jobs which was nearly even with December and about one-third of the prior year.

February produced strong gains though, with 12,000 new jobs added. This was a 224% monthly gain and 580% year-over-year when the industry reported a loss of 2,500 jobs.

March was closer to what January looked like with only 2,000 new jobs added. This was an 83% drop for the month that is probably only comforted by the 122% year-over-year gain.

Compared to Q4 2021 first-quarter gains were down about 32% for the Finance and Insurance industry. However, this was an impressive year-over-year improvement at 343% over Q1 2021. Due to the volatility of this industry segment last year, the first quarter of 2022 has reported almost half of the job gains posted in all of 2021. (17,700 in Q1 2022 compared to 35,700 new jobs in 2021.)

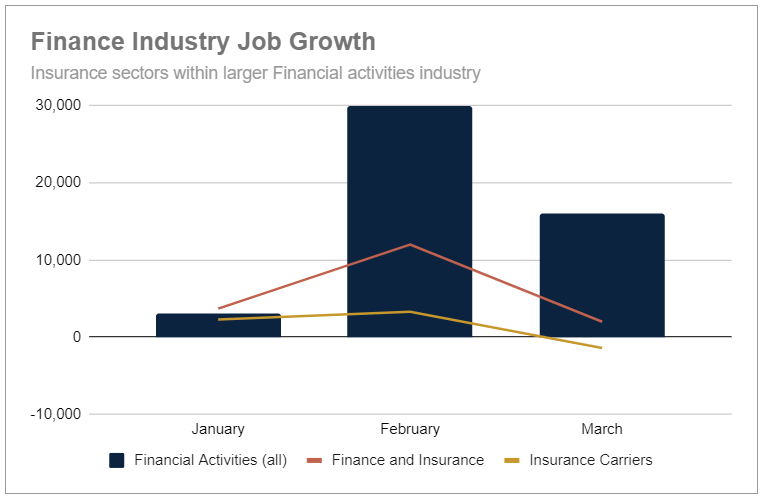

We took a closer look here too comparing Finance and Insurance and Insurance Carriers against the larger Financial Activities Industry.

As a whole, the Financial Activities industry got off to a very slow start to the year with only 3,000 jobs added in January before jumping 900% with 30,000 new jobs in February. March only reported half that volume with just 16,000 new jobs.

Reviewing the sector of Insurance Carriers, this segment reported 2,300 new jobs in January. Another 3,300 (a 43% increase) were added in February before cutting that gain nearly in half with a loss of 1,400 jobs in March.

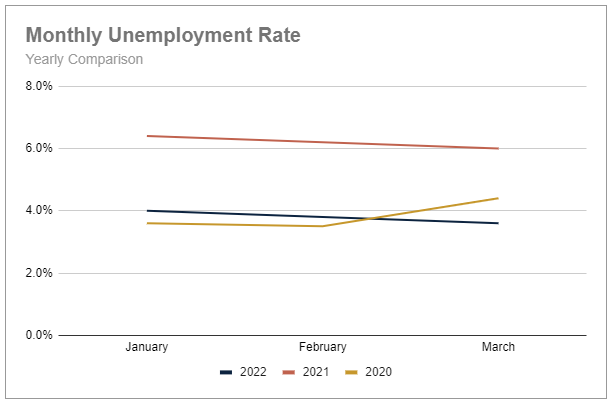

United States Unemployment Rate

The decline in the monthly unemployment rate mirrored the .2% monthly decline we saw at the beginning of last year, just at a consistent 2.4 points lower each month. The unemployment rate was at an even 4% in January, ending the quarter at 3.6%, a level that hasn’t been seen in two full years.

The unemployment rate in Professional and Business Services ended the quarter at 4%, 2.7 points below where it was one year ago. The Financial Activities industry has one of the lowest unemployment rates at just 2%. (Only Government workers post a lower rate at just 1.5%.) At the end of March 2021, the unemployment rate for the Financial Activities was 1.4 points higher at 3.4%.

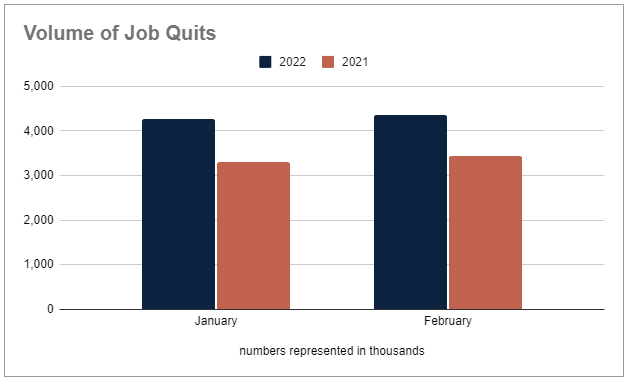

Job Quit Trends

Despite the positive news of steadily declining unemployment rates, the levels and rate of job quits in the U.S. continue to be at an all-time high. For the first two months of this year, 4.3 million workers quit their jobs in January with another nearly 4.4 million workers quitting in February. This was 2.8% and 2.9%, respectively of the total U.S. workforce.

Unfortunately, the predictions for this 2022 trend to continue are holding true. For the first two months of the year, this is already almost a 28% increase over the beginning of 2021 and nearly 23% above the first two months of 2020.

This year is going to require organizations to be equally diligent in how they attract and retain talent.

U.S. Hiring Trends

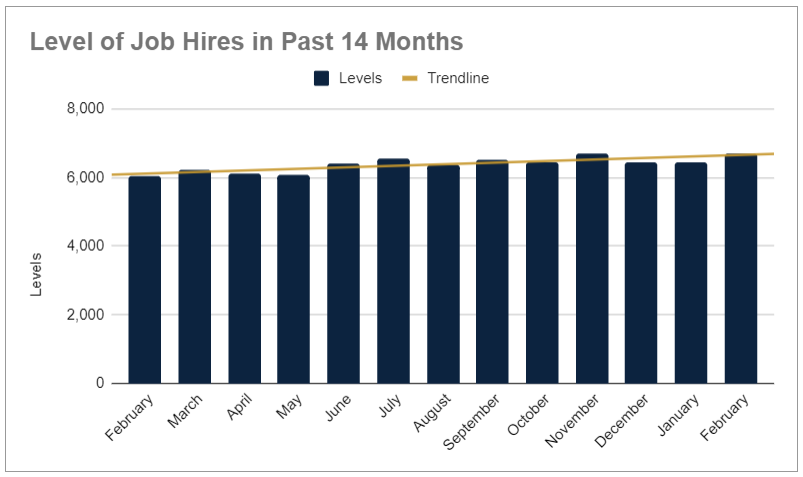

While the volume of new jobs added continues to fluctuate each month, and more so each quarter, the level of job hires remains on a much calmer and slowly trending upward course.

Here’s the important point. In just the first two months of this year, over 13 million jobs were filled while only 1.3 million new jobs were added. As the unemployment rate continues to decrease and the participation rate continues to increase (62.4% at the end of March) competition for top talent is going to be more intense. Even if businesses are still filling the gaps created by the pandemic, hiring at a rate ten times faster than what new jobs are being created will require companies to be more creative in their recruitment strategies.

The gap is even more pronounced in certain industries. In Business and Professional services positions are being filled thirteen times faster than new roles are being created. In Finance and Insurance, the rate is a staggering sixty-two times faster. There’s a reason why we advise organizations to remain in a consistent mode of hiring.

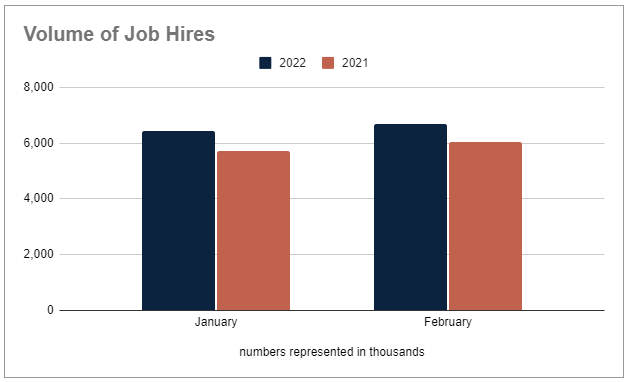

Like job quits, reports for the level and rate of job hires in the U.S. lags by a couple of months. That said, in January over 6.4 million workers representing 4.3% of the U.S. workforce were hired. This was only marginally lower (.4%) than December. However, 12% above January 2021 levels.

In February nearly 6.7 million (4.4% of the workforce) more people here hired representing a 4% month-over-month increase. Year-over-year this was an 11% increase.

Geographically, the southern U.S. has been most active in hiring with 5.4 million hires in the just first two months of this year. Meanwhile, the northeastern region has made the fewest hires over the same period, with just 2 million.

Industry Employment Trends

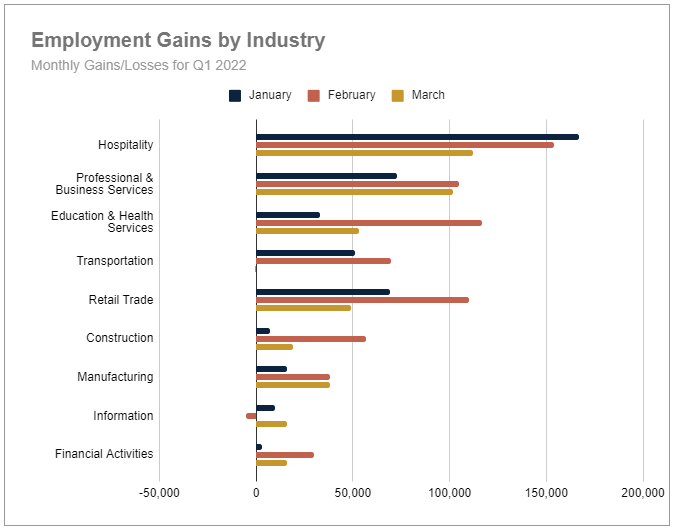

Across the nine industries we regularly watch, there were only two instances of job losses last quarter. The first was the Information industry with a loss of 5,000 jobs in February, half of the gains in January, before rebounding with a net gain in March. The second was in March when the Transportation industry was essentially flat with a loss of just 500 jobs. While insignificant on its own, the decline feels more substantial after the solid gains in January and February.

Other than the Hospitality and the aforementioned Information industries, February was the strongest month for job gains for this group.

Year-to-Date Industry Employment Trends

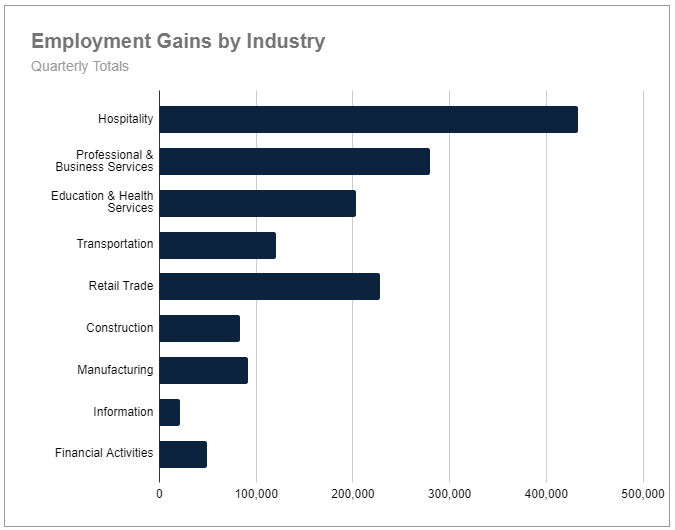

For the quarter the Hospitality industry continued to lead the way in job creation with 433,000 new jobs. The next tier was Professional and Business Services, Retail Trade, and Education and Health Services with gains ranging from just over 200,000 to 280,000 additional jobs.

Transportation, Manufacturing, and Construction all continue to hover just above or below the 100,000 mark for the quarter. While Financial Activities and Information complete the pack, both below 50,000 new jobs.

Here is the biggest takeaway from the past quarter’s labor market statistics. The overall Labor Market continues to report more positive numbers than it did two years ago. Unemployment levels continue to decline, workers continue to become more engaged in the labor market, and businesses are actively hiring.

While respective industries and geographic markets will continue to rebound and fluctuate at different rates, the collective market seems to be finding a new equilibrium and balance. The challenge will be finding meaningful ways to engage and develop current employees to improve retention rates.

Get this quarterly labor reports delivered directly to your inbox. Subscribe to our newsletter today.

.jpg)

.png)

.png)