Details are important. They help us provide consistency and avoid mindless errors. Yet, when we become too focused in some areas, we can miss the bigger picture and perspective that is helpful to understand the full story. It’s the “missing the forest for the trees” analogy.

Earlier this year, we started reporting on some of the key labor market metrics relevant for our client base each quarter. Our goal was two-fold. First, to provide an overview of what was happening in the labor market. Second, to provide a helpful perspective on what these trends might mean for your business or organization. (We do hope they are providing the intended value.)

When we took a look back not just at the fourth quarter of 2021 but the entire year as well, another commonly heard phrase came to mind: “the only thing that is constant is change”.

Change can be good. It can signal growth and progress. The key to making change positive though is to remain adaptable and open to new possibilities. While it hasn’t always been easy to navigate the changes thrust upon us the past two years, you should take tremendous pride in your ability to endure, learn, adjust, and in many cases, also thrive.

We expect more changes in the labor market and employment trends to appear over the next year. Take a peek at this article for our 2022 predictions. For now, here’s a look at what took place during the last quarter of 2021 and some of the larger year-over-year employment metrics.

U.S. Labor Market Activity

United States Job Growth

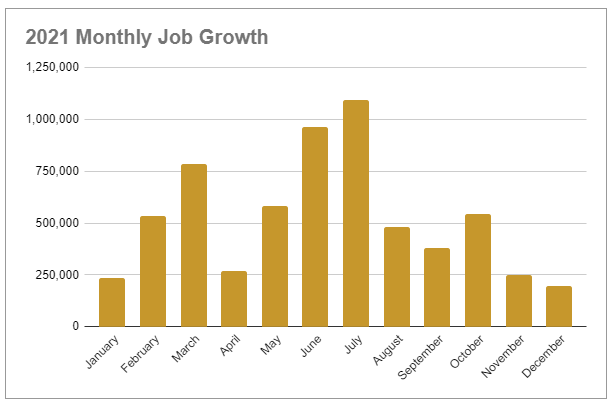

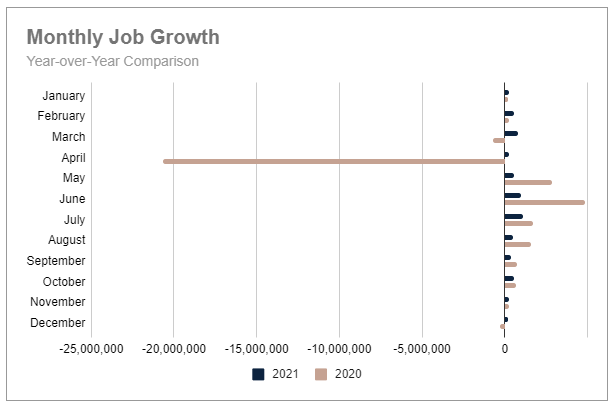

Almost one million new jobs were added in the fourth quarter (994,000) which was a 56% increase over Q4 2020. This gain also maintained the sharp and steady cumulative climb the U.S. labor market has been seeing since employment growth essentially crashed in April of 2020. However, a negative trend that followed last year’s pattern was decreasing gains each month of the last quarter. October started the quarter off strong with 546,000 new jobs which was a welcome relief to the stalling gains in Q3. Unfortunately, November gains were less than half of that at just 249,000 new jobs. For December, the labor market was only able to report 199,000 new jobs.

For the year, over 3.3 million new jobs were added to the labor market. A stark and welcome contrast to the 13 million jobs lost in 2020. Yet while substantial gains have been made, the U.S. is still operating at a deficit with plenty of ground to make up since this is only 25% of the jobs lost.

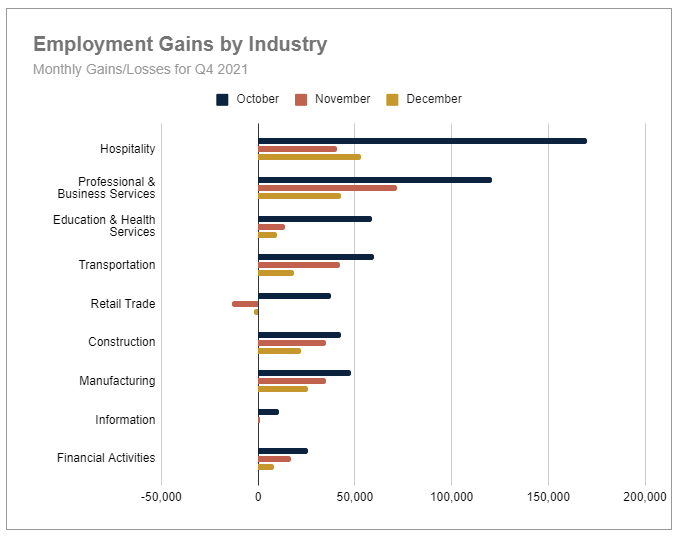

While every industry sector did post overall gains in Q4, the largest growth came in the Hospitality and Professional & Business Services sectors. The smallest gains were reported by the Information and Retail Trade industries which had net job losses or no to limited growth in November and December.

The reason behind these numbers has been a change in consumer spending. Consumer spending on goods has been slowing since April, while spending on services has been picking up momentum this past year.

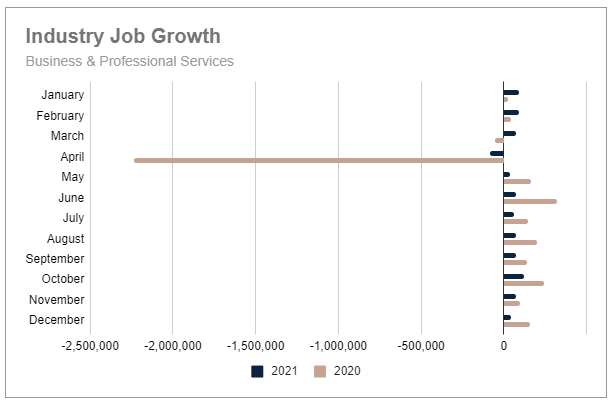

Job Growth in the Business & Professional Services Industry

The Business & Professional Services vertical started off the fourth quarter incredibly strong with the addition of 121,000 new jobs. Unfortunately, growth quickly slowed with only 72,000 new jobs added in November and just 43,000 in December. This was a total gain of 236,000 new jobs, an increase of 12% for the quarter, but only 52% of what was added in the last quarter of 2020.

The largest gains in the sector were in Computer Systems Design and Architectural and Engineering Services. The most significant job losses were in Business Support services.

For the year, 730,000 new jobs were added which nearly recouped the 754,000 jobs lost in 2020.

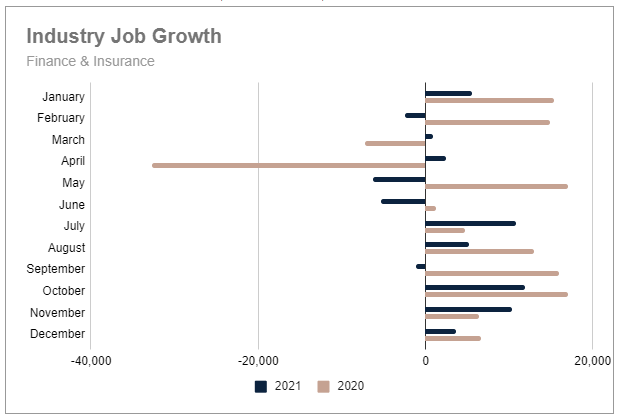

Job Growth in the Finance & Insurance Industry

The Finance and Insurance industry was able to post job gains each month of the quarter for the first time in 2021. October gained almost 12,000 new jobs, November posted just over 10,000, and December gained 3,600. While this sector too had slowing momentum, the quarterly total of almost 26,000 new jobs was the largest quarterly gain for the year.

The highest segment of job gains in this sector was with Insurance Carriers which was a welcome rebound from Q3 losses. Meanwhile, the largest job losses were seen in Depository Credit, specifically Commercial Banking.

For the year, almost 36,000 jobs were added in this industry making up half of the total job losses (72,500) in 2020.

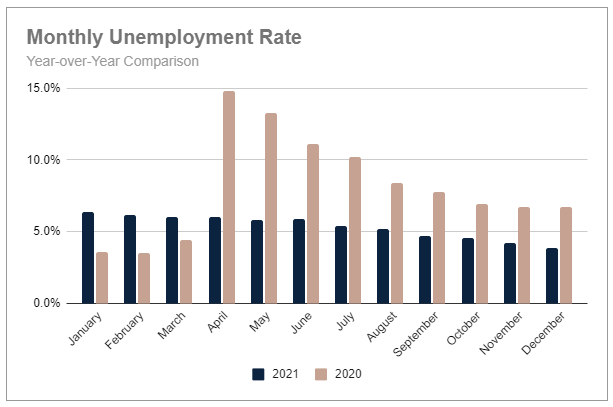

United States Unemployment Rate

The unemployment rate continued to decline in the fourth quarter, ending the year at an impressive 3.9%. This was down from 4.6% in October and 4.2% in November. Further, it brings the unemployment rate more in line with 2019 rates which ranged from 3.5 - 4.0%.

For the year, the unemployment rate has fallen 40% (2.5 points) from the highest level in January at 6.4%. The monthly average of 5.4% was nearly 3 points lower than the 8.1% average in 2020.

December unemployment rates continue to be highest in the Leisure & Hospitality and Construction industries at 6.7% and 5%, respectively among the industries we are tracking. On the other end of the spectrum, the lowest rates are held by Education & Health services at 2.1% and Financial Activities at 2.4%.

Job Quit Trends

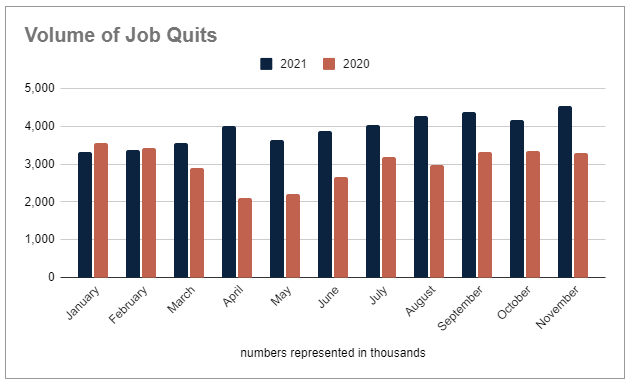

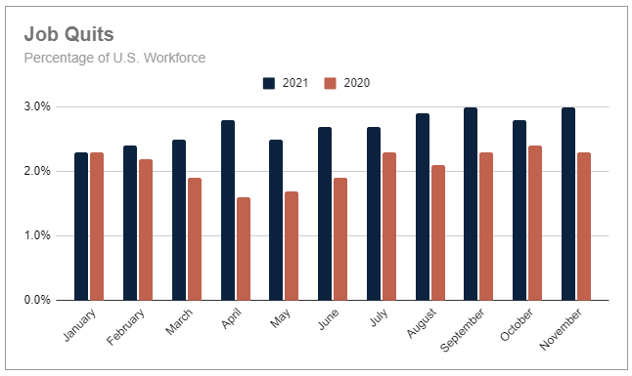

A sobering statistic we started tracking this year was the level and rate of job quits. While reporting from the Bureau of Labor Statistics lags by a couple of months (December numbers will be available in early February) the numbers for January through November 2021 have been a stern wake-up call for businesses across all industries and categories.

In October, over 4.1 million U.S. employees quit or changed jobs which was a slight decrease of 3% to 2.8% of the total workforce. Unfortunately, November numbers again increased to just over 4.5 million employees or 3% of the workforce.

From January through November of 2021, over 43 million people submitted their resignations. This was an 18% increase over 2020 already.

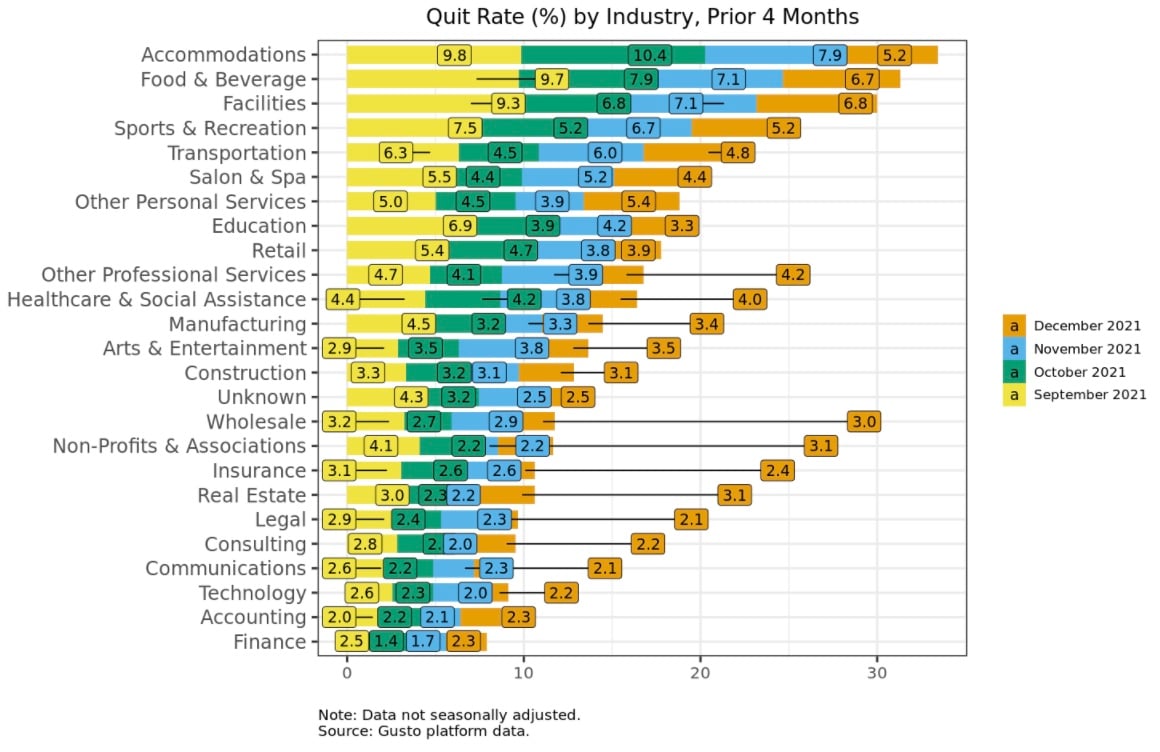

The payroll and HR platform, Gusto, recently shared their data trends from over 200,000 businesses. Looking at data from February 2020 to now, a few key findings stand out:

- While monthly quit rates have been fairly volatile over the past 22 months, the larger trend in rates has been steadily climbing.

- Females have maintained a higher quit rate than their male counterparts over the same period.

- Younger employees (those 24 and under) have much higher quit rates with more seasonal spikes. While expected, their activity can skew total quit volume.

- Over the past 4 months, Hospitality related industries continue to have the highest quit rates, while Finance, Consulting, and Insurance industries have some of the lowest rates.

U.S. Hiring Trends

Industry Employment Trends

This quarter, seven of the nine leading industries we track saw positive job gains in all three months. Retail Trade was the only industry to see declines in job growth for both November and December. The Information sector was virtually flat with real gains only occurring in October.

The most substantial growth happened in the Hospitality industry with a collective 264,000 jobs added. Professional & Business services were close behind with 236,000 new jobs in Q4.

Year-to-Date Industry Employment Trends

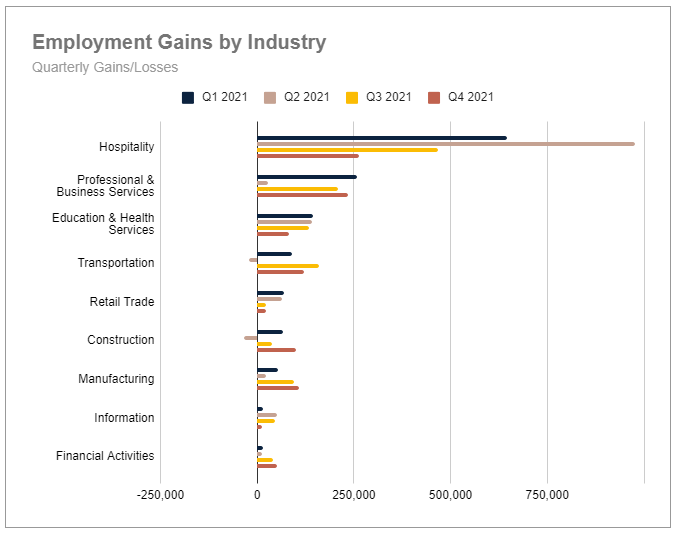

Taking a wide view of job growth in 2021, Professional & Business Services, Health & Education, and Retail Trade all made their largest gains in the first quarter of the year. Hospitality and Information found their strongest period in Q2, with Transportation hitting its stride in the third quarter. Meanwhile, Construction, Manufacturing, and Financial Activities waited in the last quarter of 2021 to post their biggest gains.

Except for a few outlying quarters for nearly all reported industry sectors, Hospitality and Construction were the most volatile with the largest percentage swings in gains or losses between quarters. Education & Health Services was the most consistent in their quarterly gains despite a slowing momentum as the year progressed.

There are several encouraging trends we see in the U.S. labor market.

- While job growth was not always as expected or gains consistent, each month did post positive gains rather than the harsh job loss numbers of 2020.

- The unemployment rate continues to decline each month as more eligible workers return to gainful employment and businesses slowly return to pre-pandemic activities.

- Despite some industries rebounding faster than others, all the sectors reported have had two consecutive quarters of positive job gains.

- Even the increasing number of job quits has a silver lining with the best companies investing in the aspects of their business that matter most to employees: growth opportunities, inclusive cultures, and competitive compensation.

Get our quarterly labor reports delivered directly to your inbox. Subscribe to our newsletter today. Then download our guide to Employee Engagement Strategies for helpful ways to manage one of your biggest assets.

.jpg)

.png)

.png)